#1 in a Series on the Art of Scalability, Transforming the Future of the Art World

Mastering The Art of Growth: Sotheby's Case Reinforces Transparency as Non-Negotiable

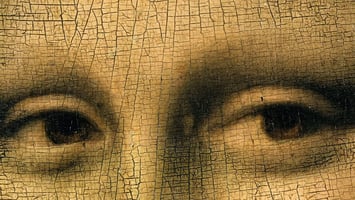

After the Gavel Falls: Why the recent Leonardo Da Vinci Sotheby's Case proves the importance of Art Market Transparency to avoid costly Legal Woes and is the Key to Market Growth

In the ever-evolving realm of art transactions, the recent resolution of the Sotheby's case involving Russian billionaire Dmitry Rybolovlev underscores the significant impact of integrity and transparency in reshaping a resilient and legally sound art market.

In the ever-evolving realm of art transactions, the recent resolution of the Sotheby's case involving Russian billionaire Dmitry Rybolovlev underscores the significant impact of integrity and transparency in reshaping a resilient and legally sound art market.

At the core of the legal dispute were allegations suggesting that Sotheby's, one of the largest and most prestigious auction houses, played a role in facilitating art buyer Yves Bouvier's actions in overcharging Rybolovlev for a number of artworks, most famously the Salvador Mundi. Despite the jury's verdict in favor of Sotheby's, Rybolovlev who previously emerged “victorious” in his separate settled case against Bouvier, is actually playing the” hero” for all art buyers and sellers around the world. This case highlights the need for transparency to foster trust within the art community and mitigate potential legal challenges. Regardless of the favorable outcome in Rybolovlev’s art sales he appears to have been cheated by his art dealer and one of the world's most established auction houses who hid behind the veil of art privacy to violate contracts and abandon ethics.

To fortify confidence in the art world and circumvent legal complexities similar to this situation, prioritizing transparency is essential.

Here are key takeaways from the Sotheby's case:

1. Integrity is Non-Negotiable:

The art market is built on trust, and integrity is the foundation upon which this trust is established. Sotheby's ethical practices in the past made this lawsuit possible. Ethical practices can not be negotiable especially when full transparency is not possible as in private sales. A commitment to ethical practices and a clear code of conduct to avoid conflicts of interest not only preserves the reputation of the auction house but also instills confidence in buyers and sellers.

2. Transparency Mitigates Risk:

Transparent transactions are a powerful antidote to risk. This case illustrates that when the entire process is not open and above board, the likelihood of legal issues increases significantly. Transparency helps in clarifying the true value of artworks, reducing the potential for disputes and litigation, thus creating a more stable and secure market environment.

3. Increasing Liquidity through Trust:

Since liquidity is a concern when considering Art as an asset class, prioritizing integrity and transparency will make art more attractive to a broader range of investors. Trustworthy transactions build confidence, attracting liquidity and fostering a healthier market ecosystem where buyers and sellers can engage with greater ease and efficiency.

4. Avoiding Legal Quagmires:

Legal entanglements can be costly,time-consuming and come with significant reputational risk. Sotheby's successful defense in this case should be a warning to all of the importance of conducting transactions in a manner that not only adheres to legal requirements but goes above and beyond to ensure ethical practices. Avoiding legal pitfalls enhances the overall efficiency of the market and preserves resources for all stakeholders.

5. Embracing technological solutions

Technology can play a significant role to reduce risk and increase transparency in the art market. Anti-fraud technologies offer new forms of data governance, providing transparency in data exchange and enhancing trust in transactions. Modernizing risk management in the art market, and offering a platform for conducting due diligence on artworks and transactions, ultimately reduces exposure to more traditional art pitfalls.

In conclusion, the Sotheby's case underscores the ethical and strategic importance of integrating transparency and trust mechanisms into the art marketplace. By leveraging technological innovations that enforce standards and transparency, the art market can work towards fostering a more, trustworthy environment, ultimately reducing risk, and increasing participation and liquidity. This case should serve as a wake-up call for the industry to implement and uphold ethical conduct and transparency in every transaction, while also embracing modern solutions to enhance the overall integrity and efficiency of the art market.